Why Do This?

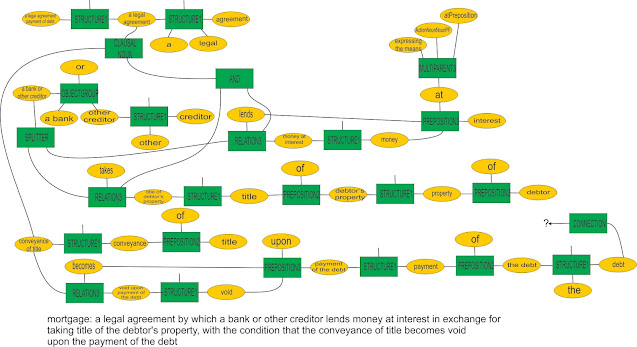

Sitting here implementing the meaning for “mortgage”.

The dictionary definition is:

a legal agreement by which a bank

or other creditor lends money at interest in exchange for taking title of the

debtor's property, with the condition that the conveyance of title becomes void

upon the payment of the debt

There is a bit of confusion – “lending money at interest”

and “the debt”. It needs sprucing up, but the basic ideas are there.

It does describe the inner workings of a mortgage – the

conveyance that is voided when the debt is paid.

It looks like:

A few details – payment is an action or an amount (actually

both – “the $500 payment was late”). If it is an action, it has a timestamp, so

“upon” means when the action occurs.

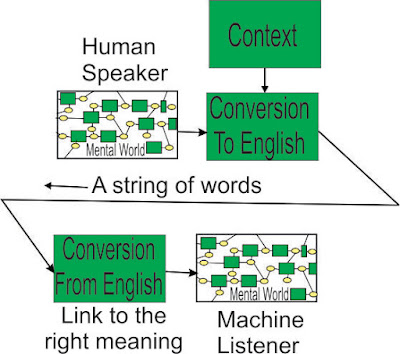

Banks are talking excitably about using Generative AI throughout their operations – save money, better service.

What does a Generative AI know about the inner workings of a

mortgage? Not much.

It relies on statistics of word linkages – “home mortgage”,

“mortgage broker”, etc. It understands nothing – should be great for customer

interaction, until the customer realises how empty it is. It also likes to

generalise – the only way it can hope to get the right meaning – by using very

many instances of propinquity, so it may end up telling the bank’s customers

about a rival’s offering. If it is trained on only the bank’s documentation, it

will perform poorly – and the bank may have several offerings in the mortgage

space.

A bank uses quite a lot of “soft” technical terms in dealing

with its customers – account, deposit, withdrawal, advance, mortgage, rate,

fixed interest, payment, due, credit foncier, overdraft. Is a system that only “understands”

a word by the words it is close to fit for purpose?

Why are we continuing on with our AGI product?

Because we believe that understanding the meaning of words

is far more useful than counts of word closeness. Generative AI looks like

another wave of junk – great for generating marketing fluff, but unsuited to

areas where the meanings of words matter.

The AML Act blows the Generative approach out of the water –

the meanings of the words is what the Act says they are, not how they are

connected in some other document. A complex deed for a billion dollar loan will

do the same thing – only the lawyer sort of understands what it says, and then only the lawyerly bits - the risk to completion is someone else's worry.

Comments

Post a Comment